This is the second installment in a series of posts centered around data from the 2015 LSSSE Survey administration and the 2015 Annual Report, which provides a retrospective glimpse into law student debt trends over a 10-year period, 2006 to 2015, with 2011 as a midpoint. This post discusses student debt trends based on institutional sector—i.e. whether the law school is public or private.

In each of the three survey years we studied—2006, 2011 and 2015—higher proportions of respondents attending private law schools expected debt above $120,000, compared to their peers at public schools. Throughout higher education, private school tuition tends to be higher than those at public schools—a reflection of the relative absence of public subsidies to private schools. In both realms, the proportions of respondents who expected debt above $120,000 increased between 2006 and 2015.

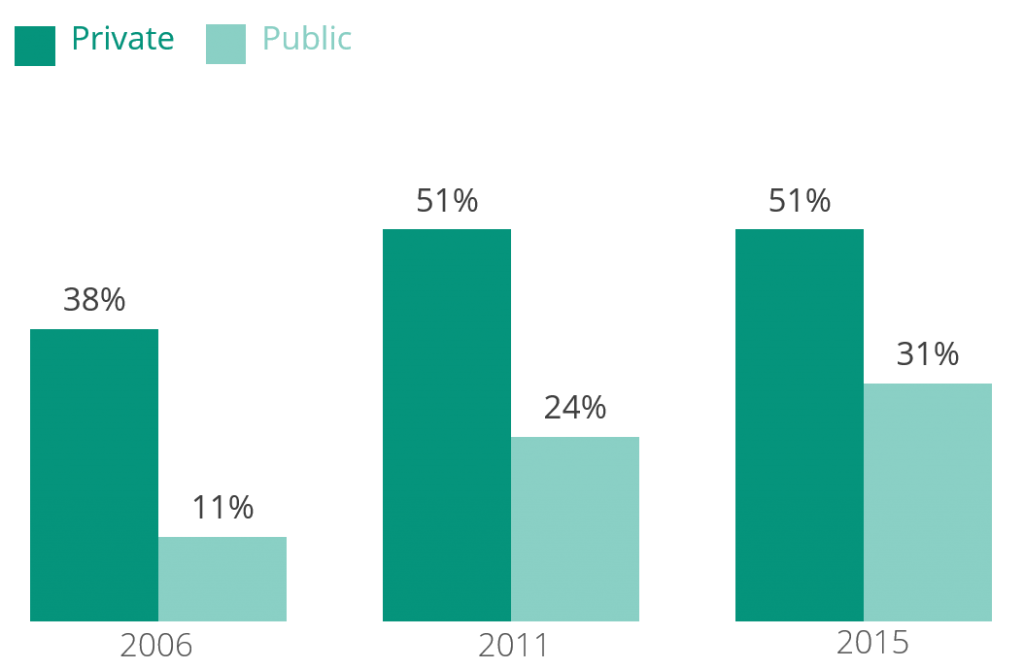

In 2006, 38% of private school respondents expected to owe more than $100,000; in 2011 and 2015, that proportion exceeded 50%. Tuition and, therefore, debt is growing dramatically at public college and universities, due in large part to declines in the aforementioned state subsidies. While the high-debt expectations were lower among respondents attending public law schools, the increases over the survey years were more dramatic. In 2006, only 11% of LSSSE respondents expected debt of more than $100,000; by 2015, this proportion had almost tripled to 31%. [i]

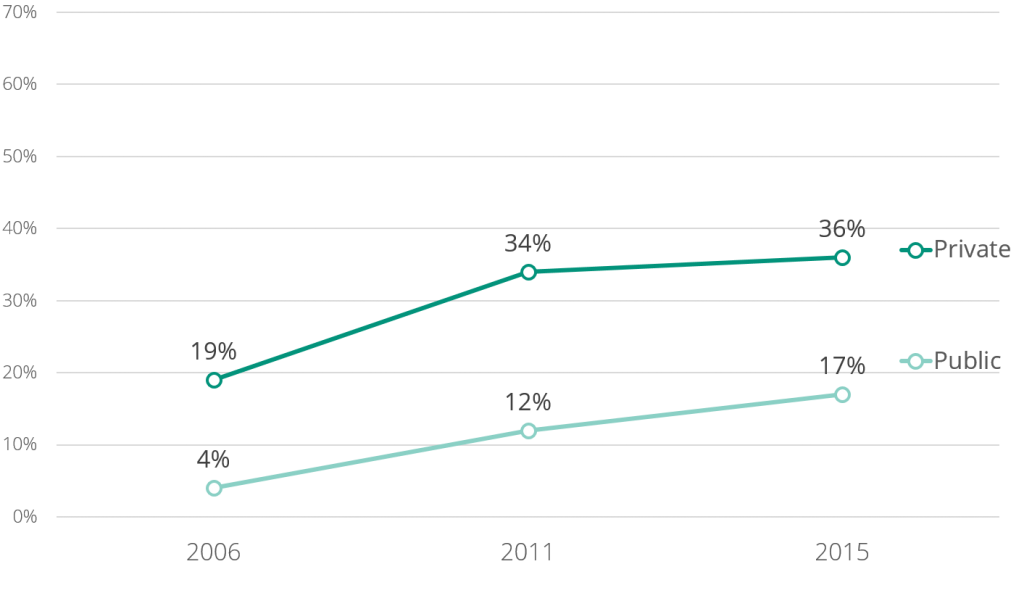

The increases were even more compelling among respondents who expected more than $120,000 in debt. In 2006, only 4% of public school respondents expected debt at this level; by 2015, that proportion had more than quadrupled to 17%. The same proportions almost doubled among private law school respondents—19% in 2006 and 36% in 2015. [ii]

Focusing once again on the subset of respondents who expected to owe more than $100,000, in 2015 a whopping 71% of those respondents who attended private schools expected to owe more than $120,000. Fifty-six percent of this high-debt subset at public schools expected to owe more than $120,000 in 2015—the first year this proportion crossed the 50% threshold.

[i]. Proportion of respondents who expected to owe more than $100k

[ii]. Proportion of respondents who expected to owe more than $120K