Guest Post: Paying for Law School and the Public Service Loan Forgiveness Program

Guest Post by CJ Ryan, J.D., Ph.D.

Guest Post by CJ Ryan, J.D., Ph.D.

Associate Professor of Law, Roger Williams University School of Law

Affiliated Scholar - American Bar Foundation

Legal education in 2019 is a costly proposition for most law students. The average cost of tuition and fees at private law schools was $49,095 and $40,725 at public law schools, for out-of-state students, in the 2018-2019 academic year, to say nothing of living expenses and other costs that students pay out of pocket.[1] As a result, many law school graduates carry significant student loan debt upon completing their studies. In fact, the average amount borrowed by law school graduates totaled $115,481 for the graduating class of 2018.[2]

When discussing student loan debt, it is easy to fixate on the aggregate impact of the burdens this debt places on tax payers, the economy, and borrowers alike, such as the depressive effects that law school loan debt has on homeownership and entrepreneurship.[3] Yet, a discussion of which graduates are saddled with the largest student loans is often absent from conversations about student debt.

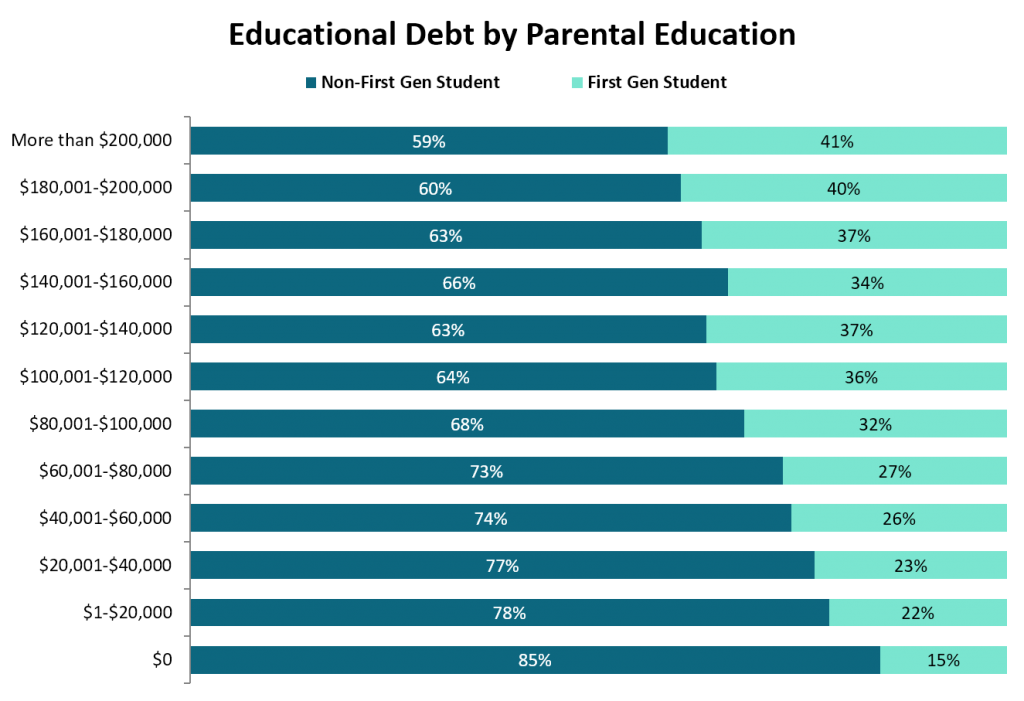

The results of the 2018 Law School Survey of Student Engagement (LSSSE) reveal that students from the lowest socio-economic backgrounds, as proxied by parental education, expect the greatest debt loads upon graduating from law school. In fact, among students expecting to owe between $180,000 and $200,000, 40% of these students have parents whose highest level of educational attainment was less than a baccalaureate degree, and the proportion jumps to 42% of students who expect to owe more than $200,000 in student loans from attending law school. Thus, unsurprisingly, students from the lowest socio-economic backgrounds borrow the most to finance their legal education and, perhaps as a result, are on the hook for the largest debt sums.

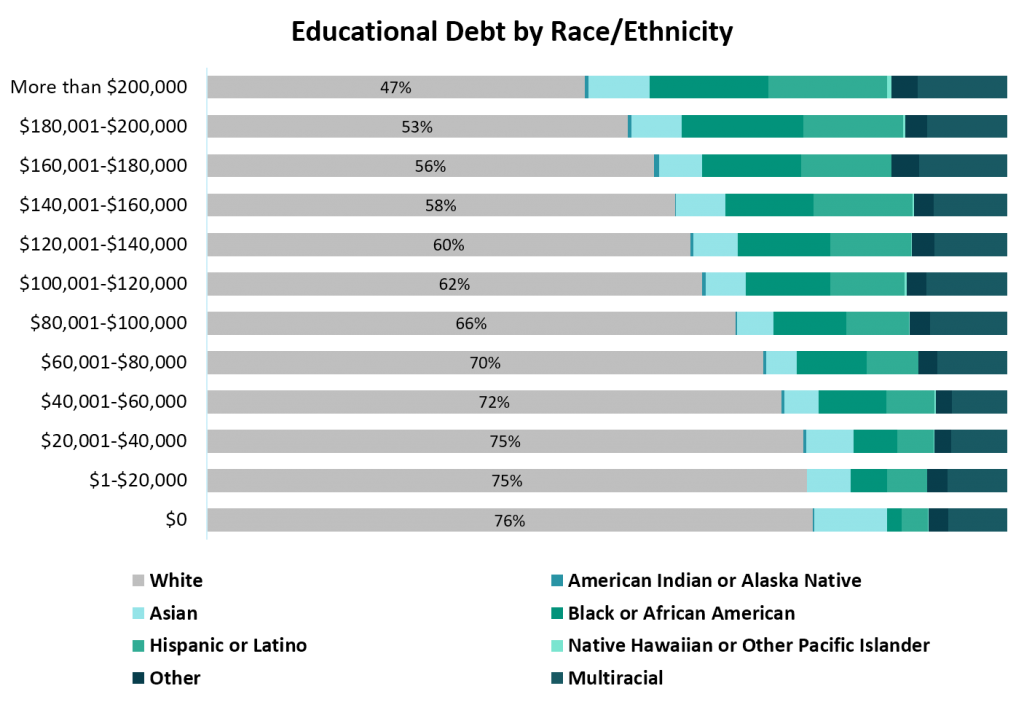

Furthermore, students from racial minority groups account for the largest expected law school debt loads. Of the students surveyed by LSSSE who expected to owe more than $200,000 in law school loans following their graduation, 53% identified with a racial group other than White. Thus, the disparate impact of the highest law school loans is greatest among racial minorities.

Fortunately, income-based repayment options for student loans make paying back significant debt loads for law school graduates more manageable. One repayment option, the Public Service Loan Forgiveness (PSLF) program, even forgives borrowers a portion of their student loan debt, subject to paying into the program for 10 years of full-time employment with a government organization, or a qualifying public service or tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code.[4] However, the future of the PSLF remains uncertain, as the Department of Education, as well as President Trump, have announced plans to eliminate PSLF.[5]

In the fall of 2017, I administered the Law School Choice Survey at four law schools: a private elite law school; a public flagship law school; a public regional law school; and a private new law school.[6] The response rate within this sample of law students was quite robust—45%, 34%, 40% and 43%, respectively—and respondents to the survey were representative of their law school’s entire population on the basis of race and gender, within two%, in each category.[7] The survey queried current law students about their career aspirations and whether they planned to take advantage of the PSLF program to repay their student loans. Responses from students at the public flagship law school indicated that 16% of White students planned to enroll in or were already enrolled in PSLF, but 20% of the African-American students and half of the Hispanic/Latino students planned to enroll in or were already enrolled in PSLF. At the public regional law school, nearly 29% of White students indicated that they planned to enroll in or had already paid into PSLF, but half of the Hispanic/Latino students and 70% of African-American students planned to enroll in or had already paid into PSLF. At the private new law school, 33% of African-American students and over 35% of White students surveyed indicated that they plan to avail themselves of PSLF.[8] Furthermore, nearly 77% of students at the public flagship law school, and over 55% of students at the public regional and private new law schools, with expected law school loan debt exceeding $100K, indicated that they plan to enroll or were enrolled in PSLF. These results demonstrate that a significant proportion of racial minority students, as well as their White counterparts, and students with the greatest expected debt loads view the PSLF as their primary recourse for repaying their law school loans.

Likewise, 40% of the students whose parents earned a combined income of less than $50,000 annually plan to enroll or were already enrolled in the PSLF program at the public flagship law school. At the public regional law school, over 21% of students whose parents earned less than $50,000—but more than 44% of the students who parents earned less than $60,000 annually—are counting on the PSLF program. And over 58% of the students whose parents earned less than $50,000 annually at the private new law school indicated that they plan to use or are enrolled in the PSLF to repay their student loans.

Additionally, over 35% of students who planned to enter a career in traditional public interest sectors indicated that they planned to or had already enrolled in PSLF.[9] More than 54% of students who sought a career in a public interest sector at the public regional law school indicated that PSLF was a part of their loan repayment plans. And over 30% of students at the new private law school who plan to enter a career in the public interest sector reported that they plan to repay using PSLF.

Taken together, these results suggest that that the students who most need relief for their substantial law school loans—students from lower socio-economic backgrounds, students from diverse racial backgrounds, students considering careers in public interest law, and students carrying the highest debt loads, most of whom are the same students across these four categories—are the students most likely to enroll in the PSLF program. Thus, despite the administrative challenges associated with the PSLF program,[10] it has succeeded in attracting law graduates to careers in the public interests, and particularly racial minority law graduates.[11] As such, it presents the most viable path to ensuring diversity in the legal profession, in terms of socio-economic status and race, but it also has substantial implications for ensuring access to justice. PSLF provides an important pathway for lawyers willing to serve in public interest roles, often at dramatically lower salaries than their peers who pursue careers in the private sector, to repay their loans, while helping to address the unmet demand for legal services for those with the greatest need in our society.[12] To eliminate the PSLF program, and these important goals that it accomplishes, would be a mistake.

____

[1] See, e.g., Ilana Kowarski, See the Price, Payoff of Law School before Enrolling, U.S. News & World Report, March 12, 2019, https://www.usnews.com/education/best-graduate-schools/top-law-schools/articles/law-school-cost-starting-salary.

[2] Law School Costs, Law School Transparency, https://data.lawschooltransparency.com/costs/debt/.

[3] Alvaro Mezza, Daniel Ringo, and Kamila Sommer, Can Student Loan Debt Explain Low Homeownership Rates for Young Adults?, Federal Reserve Board, January 2019, https://www.federalreserve.gov/publications/files/consumer-community-context-201901.pdf; see also, Vadim Revzin and Segei Revzin, Student Debt Is Stopping U.S. Millenials from Becoming Entrepreneurs, Harvard Business Review, April 26, 2019, https://hbr.org/2019/04/student-debt-is-stopping-u-s-millennials-from-becoming-entrepreneurs.

[4] The Public Service Loan Forgiveness Program, Federal Student Aid, https://studentaid.ed.gov/sa/repay-loans/forgiveness-cancellation/public-service#qualifying-employment.

[5] Zack Friedman, Trump Proposes to End Student Loan Forgiveness Program, Forbes, March 12, 2019, https://www.forbes.com/sites/zackfriedman/2019/03/12/trump-proposes-to-end-student-loan-forgiveness-program/#3cb3d8e5415e.

[6] See Christopher J. Ryan, Jr., Analyzing Law School Choice, 2020 Ill. L. Rev. ___ (forthcoming 2020), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3309815. As a condition of their participation in the survey, the law schools at which the survey was administered asked to remain anonymous and only be identified by descriptive terms. The administration at the private elite law school would not permit me to ask whether students at the law school were planning to enroll or had already paid into the PSLF program; however, all other survey questions were common between law schools.

[7] See id.

[8] Curiously, no Hispanic/Latino students surveyed at the new private law school indicated that PSLF was included in their loan repayment plans but both of the Asian-American law students surveyed indicated that they planned to enroll or were enrolled in the PSLF program. However, it should be noted that the private new law school is not terribly diverse in terms of race.

[9] These law career sectors included: children’s law/ juvenile justice; civil liberties and civil rights; criminal law; education law; employment/labor law; family law; general legal services; government law; housing law; immigration law; and public interest law.

[10] Zack Friedman, 99.5% of People Are Rejected for Student Loan Forgiveness Program, Forbes, January 3, 2019, https://www.forbes.com/sites/zackfriedman/2019/01/03/student-loan-forgiveness-data/#14c9cb3e68d0.

[11] See, e.g., Public Service Loan Forgiveness Data, Dept. of Educ., March 2019, available at https://studentaid.ed.gov/sa/about/data-center/student/loan-forgiveness/pslf-data.

[12] For example, it is estimated that legal aid lawyers “are estimated to provide just 1 percent of the total legal needs in the United States each year[.]” Three Ways to Meet the “Staggering” Amount to Unmet Legal Needs, Am. Bar Ass’n J., June 26, 2018, https://www.americanbar.org/news/abanews/publications/youraba/2018/july-2018/3-ways-to-meet-the-staggering-amount-of-unmet-legal-needs-/.