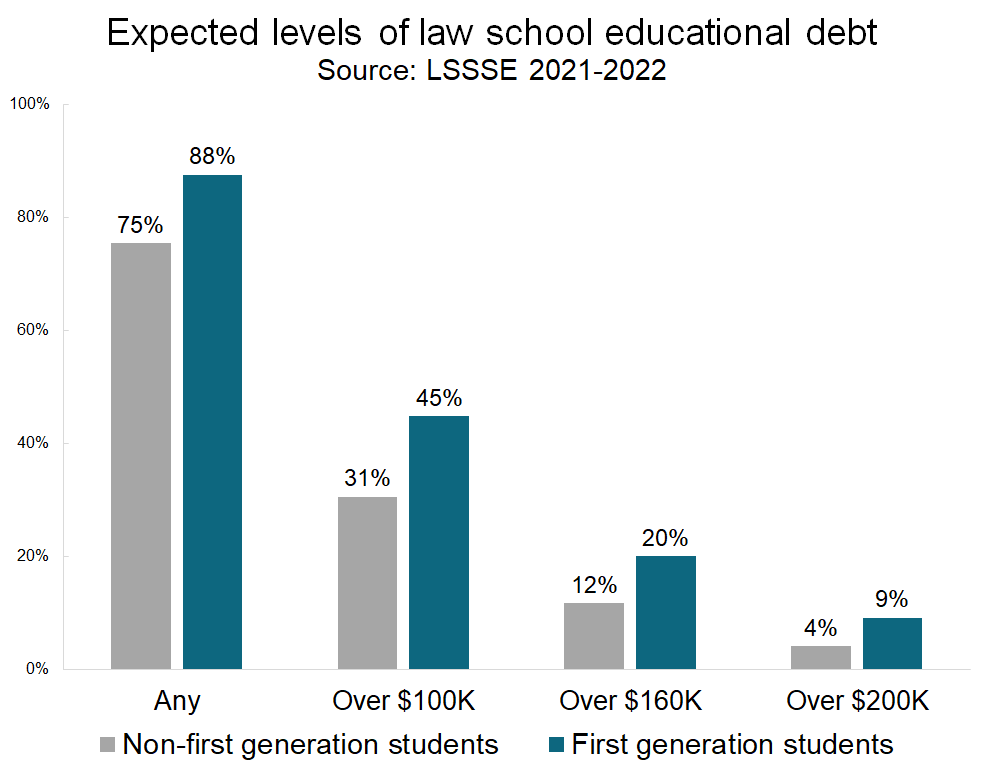

First generation law students, defined as those students who do not have at least one parent with a bachelor’s degree, face unique hurdles in higher education. In addition to navigating an unfamiliar cultural landscape, first generation students may be particularly challenged by financial concerns and student debt. In fact, although 75% of non-first generation law students expect to have some debt from attending law school, that number climbs to 88% for first generation students.

Additionally, the total dollar amount owed in student debt tends to be higher for first generation students. LSSSE 2021 and 2022 survey data show that first generation law students expected to owe an average of $96,000 compared to $71,000 for their non-first generation classmates. Around 45% of first generation students expected to owe over $100,000, but only 31% of non-first generation students expected to have loan balances that high. Shockingly, first generation students are twice as likely as their non-first generation peers to owe more than $200,000, which is the highest debt category recorded by LSSSE. Only four percent of non-first gen students fall into this category, compared to a full nine percent of first gen students.

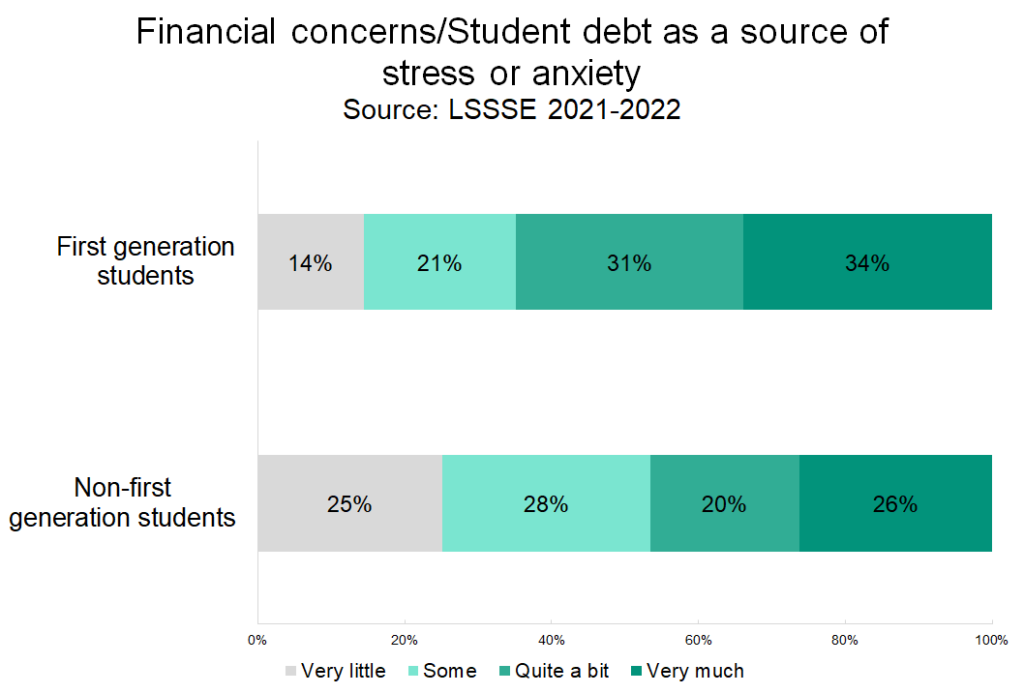

The differing financial picture for these groups of students takes an emotional toll. Although first gen and non-first gen students report similar stress levels related to law school (about 84% rank their stress a 5 or higher on a 7-point scale), two-thirds of first gen students say that financial concerns and student debt are a big source of stress or anxiety compared to less than half (46%) of non-first gen students.